Year in Review: Blockchain Ecosystem in 2023

Entering 2023, the crypto community was reeling from the collapse of Terra and FTX, sparking widespread concerns about the blockchain ecosystem’s future. But since these technologies aren’t tied to prices, we stayed cool and kept building throughout. So, from Dexola’s perspective, here’s a rundown of the most captivating crypto events that shaped 2023.

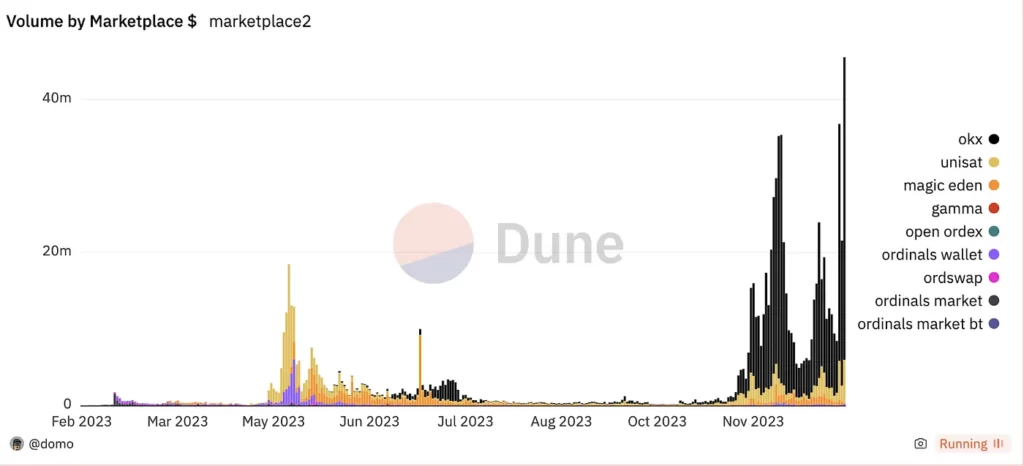

Bitcoin Ordinals

Compared to Ethereum and other blockchain protocols, Bitcoin’s core is seen as outdated due to its lack of a Turing complete virtual machine. The protocol itself is limited primarily to sending Bitcoins, and miners are notably cautious about endorsing any upgrades. The solution to expanding Bitcoin capabilities is to build on top of it, which we saw with Lightning, RGB Network, and a few other projects.

In 2021, Bitcoin developer Casey Rodamor introduced an inscription mechanism to embed unique data onto specific satoshis and store them on the blockchain. Unlike the NFTs that only store URI pointers on-chain, Ordinals store the whole digital object on-chain like image or GIF.

By February 2023, enthusiasts had created around 100,000 inscriptions, leading to a surge in interest in Ordinals. In April they were traded at over $10M daily volume, and in November they peaked at $35M daily volume.

Bitcoin Ordinals inspired developers on other chains to explore the inscription mechanism. An Ethscriptions marketplace was launched on Ethereum, Solana, and a few other networks.

In December 2023, the surge in inscriptions led to a blackout of The Open Network (TON) protocol, initially developed by the Telegram messenger team. TON’s validators’ hardware couldn’t cope with the load that an inscription creation service Tonano has created. The blackout lasted four days, causing network throughput to fall to 1 transaction per minute.

Although the inscriptions didn’t reignite the NFT market, they showed that there’s ample opportunity for innovation, even within Bitcoin.

USA vs Crypto

US market regulators, the SEC and CFTC, are wary of the crypto and blockchain ecosystem, citing potential violations of laws dating back to the 1930s.

In 2020, the SEC sued Ripple and its co-founders for selling unregistered securities. The SEC, led by Chairman Gary Gensler, intensified its scrutiny of crypto projects, asserting that any cryptocurrencies differing from PoW models are unregistered securities and, thus, should not be traded in the US. But in May 2023 judge Analisa Torres finally ruled that XRP is not a security and the sale was legal. This led to XRP growth by 100% in one day.

Ripple’s court victory sent a strong message, suggesting that the SEC might be misinterpreting the law and indicating that regulators can be challenged when they err. But the fun just started.

In June 2023 SEC sued Binance and Coinbase for being “unregistered securities exchange, broker, dealer, and clearing agency”. In November DOJ joined it and charged Binance for money laundering and aiding terrorists with money transfer services thus violating AML requirements. The lawsuit ended with Binance agreeing to pay a $4 billion fine and its famous CEO Changpeng Zhao resigning and possibly going to jail.

This wasn’t the end for the crypto market, with numerous analysts speculating that CZ was engaging in a complex strategic game, akin to 4D chess, all along. He bribed the DOJ and demonstrated the needed compliance to end the case as quickly as possible.

The most high-profile event in the USA vs Crypto saga was the trial of Sam Bankman-Fried. SBF, responsible for leading the FTX exchange into bankruptcy, fought tirelessly in his defense but ended up in detention, where he’s currently trading mackerel for haircuts, with jail time looming on the horizon. The new FTX board recovered almost all of the missing $8 billion to return it to creditors and think about relaunching the exchange.

Base and Friend.Tech

It’s become commonplace for crypto exchanges to launch their own tokens. For instance, Binance features BNB, Bybit offers BIT, Huobi (HTX) has HT, among others. With tokens, they often launched their own EVM blockchains and pursued the development of a DeFi ecosystem.

Meanwhile, Coinbase took a different route by launching an L2 chain named Base, notably without its own token. The exchange attempted to spark interest in Base with the ‘Onchain Summer’ event in August, yet the real buzz had already begun with the launch of Friend.Tech.

Friend.Tech is a SocialFi app that enables users to trade shares of their favorite crypto influencers. It’s not the first of its kind, but its team did a great job of polishing UI and UX.

First, they used built-in custodial wallets instead of the common “Connect wallet” button. Using Friend.Tech felt similar to navigating any website with deposit features. The users deposited their ETH and then operated through the app without constant transaction confirmations.

Second, they developed it as a progressive app. Instead of going to the website in a browser, users “downloaded” it and installed it on their phones. Technically, Friend.Tech was merely a bookmark on the home screen, yet for users, it functioned as a user-friendly app.

Third, they used bonding curves for price calculation. With no AMM pools and no slippage, trading becomes predictable, and liquidity is always available for buyers. It is the best choice for such kinds of dApps.

Friend.Tech is what made Base popular and launched a wave of clones on other chains. This might encourage more developers to adopt built-in custodial wallets and progressive apps for their projects, as they evidently streamline the onboarding process and boost user engagement.

Hacks, Hacks, and Hacks

In 2023, over 80 hacks occurred, averaging one every four days. Mixin Network’s cloud provider was compromised in September leading to a $200 million loss. Euler Finance was exploited with flash loans for $197 million. Multichain cross-chain protocol got hacked for $126 because of private key leakage.

We’re spotlighting not the largest incidents, but rather the most intriguing ones.

First off, there’s been a notable trend of wallet hacks. Atomic Wallet users lost $100 million because of insufficient entropy in key generation and other design flaws. And in the final days of 2023, Ledger Connect library got infected with a drainer that led to a $600 thousand loss and a panic that caused Bitcoin to drop slightly.

Secondly, there seems to have been targeted attacks against Justin Sun and his associated products. In one month, hackers broke the HTX (Huobi), Poloniex, and HECO Bridge, stealing more than $230 million combined.

It’s also important to note that the majority of DeFi incidents stemmed from vulnerabilities in smart contracts that hackers exploited. Therefore, at Dexola, we strongly recommend going through a comprehensive security audit before launching any project.

Spot Bitcoin ETFs

Although futures crypto ETFs and exchange-traded trusts exist for numerous tokens, US stock exchanges currently lack spot crypto ETFs. BlackRock, Grayscale, VanEck, ARK Invest, along with ten other asset managers, filed for spot bitcoin ETFs, aiming to enable institutions to purchase BTC on conventional exchanges.

The buzz around ETFs aided Bitcoin and the broader crypto market in surmounting issues like lawsuits and hacks, and in shedding FUD sentiment, propelling it to the $45k mark before the halving. While analysts might call it a Santa Rally, we believe that the ETF launch is being priced in.

Conclusion

This year, the crypto ecosystem was actively clearing up the aftermath of events from previous years, such as the FTX bankruptcy and Ripple lawsuits. This effort was successful. What remains is for the US Congress to implement crypto regulations, for Gary Gensler to resign, and for BlackRock to roll out their Bitcoin ETF.

Fun fact: you could open a 100x long on Bitcoin on January 1st, 2023, and never get liquidated. We hope the year 2024 will be like that, and things will only go better.