Real-World Asset Tokenization: Benefits, Process and Use Cases

There’s a lot of buzz surrounding real-world asset tokenization, also known as RWA. Tyrone Lobban, the head of JPMorgan’s blockchain division, claims that nearly all their clients — 99.9% to be exact — are interested in asset tokenization, even if they aren’t particularly keen on cryptocurrency.

In this article, we’ll explore why tokenizing real-world assets has become such a hot topic and discuss its integration and the most promising use cases.

Why Tokenize Real-World Assets

In today’s world, nearly every object has an owner. This applies to physical items like land and cars, as well as to legal entities and liabilities.

Ownership is typically verified through legal documents, such as deeds, contracts, and certificates of possession, which may vary by country. These are usually written on paper and signed by a lawyer or a public agency. Sometimes, those documents are stored online, but paper copies are still required in most cases, as the signatures and seals are considered “unforgeable.”

To sell an asset, the owner must transfer ownership rights to the buyer by drafting the required legal document, signing it, and notifying the relevant agencies. The owner must pay the associated fees and wait for the relevant agencies to update their records.

In essence, every valuable asset requires some form of ownership certificate. This certificate serves to verify ownership and must be securely issued. Most of these certificates are paper-based, although some are also duplicated in centralized digital databases.

The concept behind RWA tokenization is straightforward — replace traditional certificates with digital tokens and substitute lawyers with smart contracts to save both time and money while enhancing security:

- non-fungible tokens (NFTs) can encapsulate all the data found in a paper certificate;

- NFTs are virtually tamper-proof because their authenticity can be verified through the issuer’s address;

- NFTs can be easily transferred, signifying a change in the ownership of the real-world asset;

- when paired with zero-knowledge proofs, NFTs could allow for ownership verification without sacrificing the owner’s privacy.

Tokenization, by dividing assets into fractions, opens up investments in expensive objects to a wide range of people. This model attracts liquidity to previously inaccessible markets, stimulating trade and forming a fair price. Smart contracts development automates processes, increasing the efficiency and security of asset management.

Benefits of Asset Tokenization

The tokenization of real world assets is revolutionizing traditional asset management and solves issues. It unlocks a new era of asset ownership, offering greater liquidity, inclusivity, transparency, efficiency, and global reach.

Increased Liquidity. Tokenization of high-value assets like real estate or art simplifies investment, making them more accessible. This attracts more investors and increases liquidity and trading efficiency.

Democratized Access. Tokenization makes high-value assets accessible to a wider audience by enabling fractional ownership. This democratizes investments and allows more people to benefit from asset appreciation.

Ultimate Transparency. Blockchain technology ensures transparency and security in tokenization, minimizing fraud risk and building investor trust.

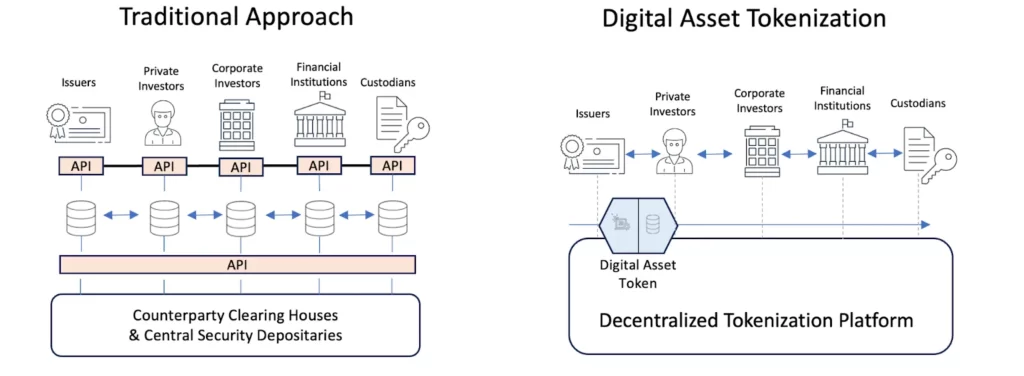

Cost Efficiency. Tokenization leverages smart contracts to automate asset transactions, eliminating intermediaries and reducing costs, fostering a more efficient and accessible marketplace for both issuers and investors.

Global Reach. Unlike traditional asset ownership, which is often confined by geographical boundaries due to regulatory complexities and logistical constraints, real-world asset tokenization offers a borderless solution. Digital tokens representing ownership can be traded seamlessly on global exchanges, welcoming a diverse array of international investors.

The upgraded accessibility significantly boosts market liquidity, enables efficient price discovery, and unlocks a plethora of investment opportunities for a global audience previously excluded from such markets.

The Tokenization Process

Tokenization is the transformation of a real-world asset’s ownership into digital representations on the blockchain. These representations, known as tokens, are tradeable assets that can be bought, sold, or exchanged. While the exact procedure varies among projects, let’s illustrate this through a simplified real estate example.

Creating digital tokens. Initially, a special purpose vehicle (SPV) is established to hold the title of the real estate property. Digital tokens are then minted, each representing a fractional ownership share in this SPV. Token holders gain proportionate rights to the property’s value and income streams, such as rental yield or potential appreciation.

Implementing smart contracts. Next, smart contracts are deployed. These self-executing protocols on the blockchain automate crucial functions like the distribution of rental income, facilitate voting on property-related decisions, and handle expense payments, ensuring transparent and efficient management.

Distributing and selling tokens. Following this, tokenized real world assets in the form of tokens are offered to investors through various channels, including private placements, public offerings, or a hybrid approach. The fractional nature of tokenized ownership expands liquidity, as investors can easily buy and sell their shares.

Asset management and governance. Importantly, token holders aren’t just passive investors; they participate actively in the governance of the underlying asset. This involves voting on matters like property management, tenant relations, and potential improvements. The specific rights and governance framework are meticulously outlined in the SPV’s charter and embedded within the smart contracts.

Secondary market trading. Finally, after the initial distribution, tokens can be traded on secondary markets, providing investors with even greater liquidity and flexibility compared to traditional real estate investments. This dynamic ecosystem allows for efficient price discovery and opens up opportunities for a broader range of investors to participate in the real estate market.

A practical illustration of real world assets tokenization can be found in the realm of credit card transactions. This exemplifies how sensitive financial data is secured while maintaining transactional functionality.

Consider the following:

- Original Asset: Your Primary Account Number (PAN), a confidential 16-digit code (e.g., 1111–2222–3333–4444), is essential for transactions but vulnerable to theft.

- Token: A unique, non-sensitive alphanumeric string (e.g., Gb&t23d%kl0U) is generated as a proxy for your PAN. This token specification holds no intrinsic value and is useless to fraudsters if intercepted.

The process unfolds as follows:

- Tokenization at Checkout. Upon making a purchase, the merchant’s payment system replaces your actual PAN with this token. This protects your sensitive data from exposure during transmission.

- Transaction Processing. The token serves as a stand-in for your PAN throughout the transaction and subsequent record-keeping within the merchant’s system. It’s linked to your customer profile but doesn’t reveal your actual card details.

- Payment Verification. For final authorization, the payment processor securely “de-tokenizes” the information, converting the token back into your original PAN. This step ensures the validity of the payment while keeping your card details shielded.

In essence, tokenization acts as a safeguard for your sensitive credit card information. It allows transactions to proceed smoothly while minimizing the risk of your PAN falling into the wrong hands.

In summary, the tokenization of real-world assets promises a more efficient and convenient system for tracking the ownership of assets in DeFi, rights, and liabilities.

Stablecoins: the Most Popular Use Cases for Tokenized RWAs

USDT, USDC, TUSD, and other fiat-backed stablecoins are essentially tokenized assets since owners can redeem them for fiat currency whenever they wish. The USD stablecoins represent the most popular use case for tokenized assets, with $170 billion tokenized.

Stablecoins like USDT and USDC are essentially tokenized assets pegged to fiat currencies. They are popular for maintaining value within the blockchain, as well as for facilitating international money transfers with lower fees.

They are primarily used by cryptocurrency enthusiasts looking to maintain their value within the blockchain, but they’re also popular among individuals seeking to transfer money internationally with lower fees than traditional banks offer.

Banks are also exploring the realm of tokenized fiat currency. For instance, Korea’s Hana Bank is investigating the use of stablecoins as an alternative to Central Bank Digital Currencies (CBDCs).

Tokenized Art: the Second Most Popular Use Case

Originally, NFTs were designed to establish ownership of digital assets, such as pictures, videos, songs, documents, and so on. They have value and are actively traded because they also have that proof of ownership included.

Numerous critics of NFTs argue that specific tokens, like BAYC and CryptoPunks, are essentially worthless, dismissing them as overhyped JPEG images. However, several NFT marketplaces have taken it a step further by allowing the issuance of NFTs that come with copyrights, commercial use licenses, rights to physical copies, and other perks.

While some criticize NFTs as overhyped, there’s a growing market for tokenized art with unique features:

- Copyrights and commercial use licenses.

- Rights to physical copies.

- Gateways to access digital content.

The value of NFTs can be extended through the implementation of gateways. For example, there is an online bookstore that sells only NFTs with the book’s cover art and lets a buyer download the book by connecting the wallet and proving the NFT ownership.

Tokenized Securities: the Most Promising Use Case

Securities like equities, bonds, and stocks can be issued as NFTs. Trading securities on the blockchain will automate various processes, including issuance, listing, record-keeping, and asset auditing. Also, tokenized securities could be traded 24/7 on decentralized exchanges.

Tokenized securities can expand these markets. Currently, many individuals in developing countries don’t own bonds or stocks, primarily due to the difficulty of finding a reliable broker. Purchasing international stocks presents an even greater challenge. The issuance of tokenized stocks, listed on decentralized exchanges, will enable broader access to investment opportunities in leading publicly traded companies.

There are such cases already: SOMA Finance plans to issue 400,000 tokenized shares worth $10 million and distribute them to retail investors on DEXes.

Tokenized Physical Objects: a Limited Use Case

Since tokens can signify ownership rights, these rights can also be traded or used as collateral. Certain blockchain platforms, such as Aracde.xyz, offer the tokenization of luxury goods, ranging from watches and supercars to T-shirt collections. Owners must send their assets to the platform’s warehouse for valuation verification. Then, the owner gets the token that represents the asset.

In most cases, owners use their tokenized luxury items as collateral to get loans on decentralized finance services. If the owner fails to pay the loan, the creditor gets the token and, in fact, the asset it represents.

Tokenized Documents: a Better Version of Documents

A few years back, Ukraine rolled out a digital ID and driver’s license app known as Diya. The point of digital documents is that they are impossible to forge and can automate many KYC processes. Ukrainian centralized exchanges integrated Diya and started verifying users’ identities in seconds.

Government-issued, blockchain-based ID certificates have the potential to greatly simplify citizens’ lives. The government could develop a custodial wallet app and directly issue these documents to citizens’ blockchain addresses.

The issuing smart contract can be configured to prevent the transfer of tokenized documents, making them theft-resistant and less prone to forging risks. Ownership of the address can be confirmed through off-chain connection transactions signed with a private key, ensuring no public records and thus maintaining privacy.

Pilot programs are underway; for example, the local government of Buenos Aires recently introduced a tokenized certificate program named QuarkID.

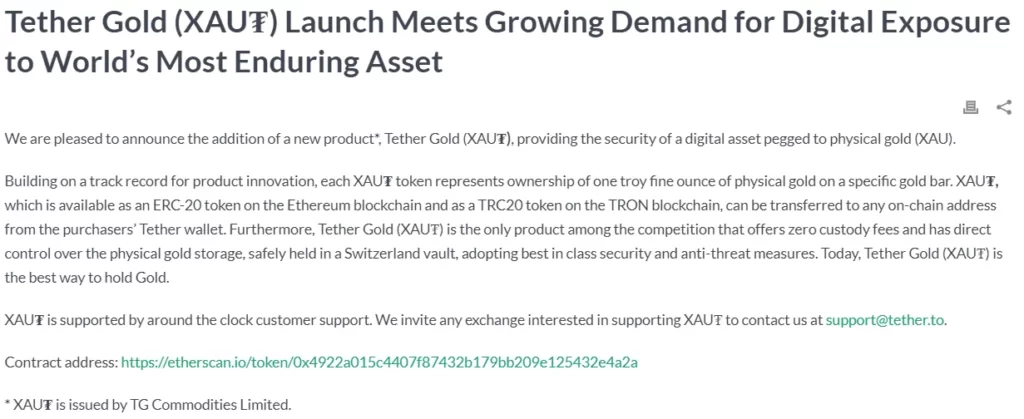

Tokenized Precious Metals

Tokenizing real world assets applies to gold, silver, and other metals, allowing investors to own a share of physical metal reserves without the need for storage.

For example, Tether Ltd has issued the Tether Gold (XAU ₮) token, which is backed by physical gold. Investors can acquire this token, thereby owning a share of gold, without the need for physical metal storage.

Tether has also recently announced the launch of “Alloy” (aUSD₮), a new digital asset backed by Tether Gold. Users can mint aUSD₮ tokens using XAU₮ as collateral. According to Tether, all XAU₮ tokens are backed by physical gold stored in Switzerland.

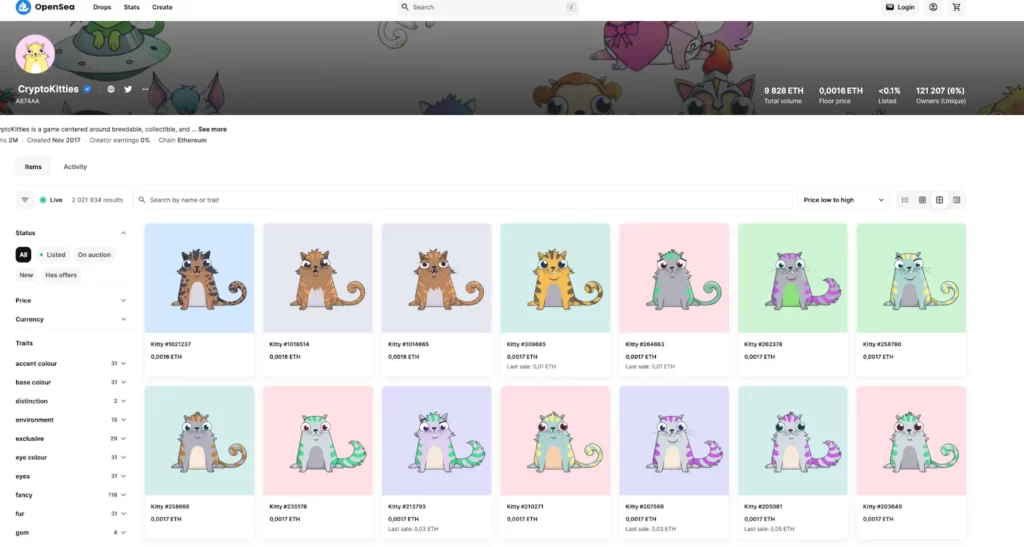

Tokenized Collectibles

Collectible items such as coins, stamps, antiques, and even sports cards can be represented as tokens, enabling collectors to easily trade them and even engage in fractional ownership transactions.

Platforms like Rarible and OpenSea allow users to tokenize and trade various digital collectibles, while projects like CryptoKitties have pioneered the tokenization of digital assets.

Tokenization of RWA which are also collectible items, akin to Google’s “Project Ocean,” may begin with asset selection, systematic scanning and description of each item. For instance, if we consider a collection of books, tokenization may involve creating unique identifiers for each book, as well as describing their key characteristics such as author, title, publisher, year of publication, etc.

Tokenized Intellectual Property Rights

Copyrights, patents, licenses, and other forms of intellectual property can be tokenized, providing owners with the ability to easily transfer, sell, and license their rights.

Imagine, the owner of the trademark and copyrights for a major film seeks financing to complete and release the movie to the market. This requires significant investments and carries the risk of production budget overruns. However, a successful film can yield investors multiple returns in a short time. If they tokenize an asset (the film) and its intellectual property rights, various individuals can become investors, gaining significant returns.

Projects like IPwe are working on tokenizing patents, allowing owners to tokenize and license them to others via blockchain.

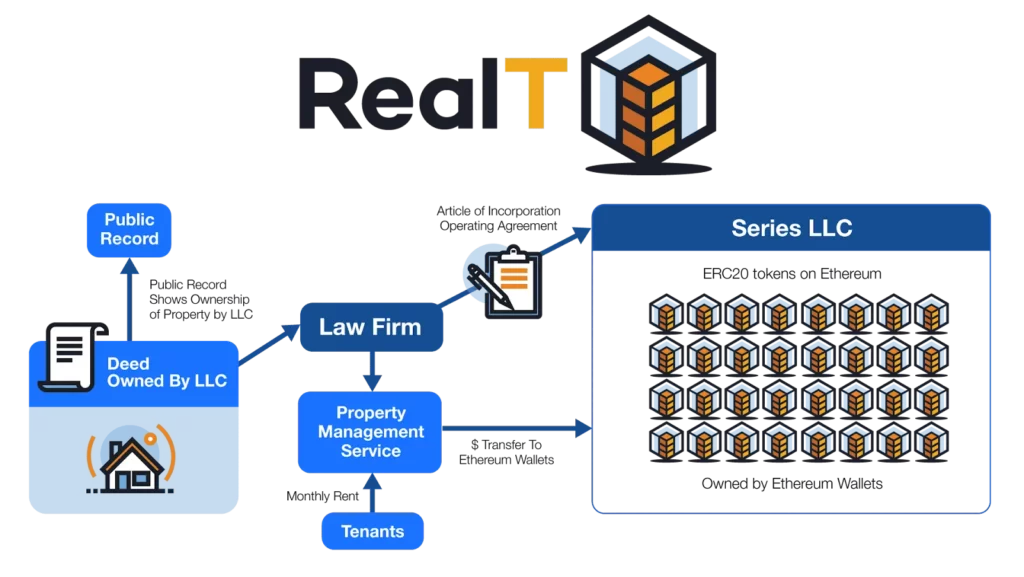

Tokenized Real Estate

In addition to physical real estate properties such as land and buildings, property ownership rights can also be tokenized, opening up new opportunities for real estate investment worldwide.

For instance, RealT tokenizes real estate properties, enabling investors to buy fractional ownership in properties across different locations.

Tokenized Startup Equity

Companies can tokenize their equity shares, allowing investors to own a stake in the company through tokens, simplifying the investment and trading process.

Platforms like Securitize and Polymath facilitate the tokenization of securities, including equity in startups, making it easier for companies to raise funds and for investors to trade these assets. For example, BlackRock launched the tokenized fund, BUIDL, on the Ethereum Network

Tokenized Agricultural Products

Agricultural commodities such as grains, livestock, and fruits can be tokenized to improve liquidity in the agricultural market and facilitate access to investments in this sector.

A known example of this sector is Agrocoin, a project that explored the tokenization of agricultural assets, allowing investors to buy tokens representing ownership in agricultural products.

Tokenized Talents and Expertise

Individual talents such as musical abilities and professional skills can be tokenized as digital assets, enabling authors, musicians, and other creative individuals to monetize their skills directly.

For example, Audius tokenizes musical talents, enabling artists to tokenize their music and generate revenue directly from fans through blockchain technology. Did you know that Skrillex uses Audius?

Completely New Assets Made Possible by Tokenization

The combination of blockchain technology, smart contracts, and programmability opens the door to creating entirely new classes of exclusive assets:

- programmable insurance contracts that utilize oracles to automatically prove an event happened and pay money;

- futures based on Bitcoin’s hashrate that deliver BTC mined in the specified period;

- programmable bonds for decentralized algorithmic stablecoins;

- certificates for prioritized on-chain transactions on busy blockchains.

Virtually anything of value or that can be owned is ripe for tokenization and on-chain trading.

Conclusion

Tokenizing real-world assets, also referred to as real world tokenization or real world assets crypto, involves issuing a digital token that signifies ownership of the given asset. Tokens can be both issued and traded on-chain, providing a transparent framework that matches regulatory compliance and auditing. Utilizing programmability allows RWA in crypto in the form of tokenized assets to be transferred effortlessly, eliminating the need for legal teams, clearing houses, and addressing cross-border complications.

At Dexola, we believe that tokenized assets represent the most efficient proof of ownership currently available, which is why we see examples of numerous FinTech companies launching their web3 divisions to explore blockchain possibilities.

Read on to find out more about: