All You Need to Know about Spot Bitcoin ETFs

On January 11th, the United States Securities and Exchange Commission (SEC) greenlit the listing and trading of spot Bitcoin ETFs on major securities exchanges. This news is a big deal for the entire blockchain ecosystem, including investors, developers, and users.

Let’s break down what you need to know about Bitcoin spot ETFs: their potential market impact, the surrounding drama, and what’s expected in the future.

Understanding ETFs

ETFs, or Exchange Traded Funds (SEC chairman Gary Gensler prefers the term Exchange Traded Products), are funds that purchase and hold non-securities for investors, providing them exposure to the asset.

In the realm of Bitcoin, there are two types of ETFs: futures and spot. Bitcoin futures ETFs track Bitcoin’s price but don’t offer ownership of the actual coins. Their price might differ from Bitcoin’s spot market price. Spot Bitcoin ETFs, however, involve asset managers purchasing actual Bitcoin for their clients, meaning the ETFs’ share prices fluctuate in line with Bitcoin’s spot price changes.

Spot Bitcoin ETFs offer retail investors direct Bitcoin exposure, sparing them the hassle of dealing with crypto exchanges. Institutions gain a way to invest in Bitcoin through familiar exchanges and brokers, holding them like regular shares, minus the extra-legal paperwork.

Before these ETFs, only a handful of companies, like MicroStrategy, Tesla, and Galaxy Digital, ventured into buying Bitcoin directly. Now, with ETFs trading on the NYSE and CBOE, even pension and private wealth management funds can invest in Bitcoin for their clientele.

How Spot Bitcoin ETFs Function

Initially, an ETF issuer purchases Bitcoins, primarily from crypto exchanges like Coinbase, and then issues shares, each representing a fraction of Bitcoin, say 0.001 BTC. These shares are then listed and traded on exchanges.

The share price of these ETFs isn’t a direct reflection of Bitcoin’s price. Rather, it’s determined by the market and authorized participants who manage the creation and redemption of shares based on supply and demand. So, while active trading of Bitcoin ETFs doesn’t directly steer Bitcoin’s price, a consistent demand for these shares could lead authorized participants to purchase more Bitcoin, influencing its market price.

The Market Impact of Spot Bitcoin ETFs

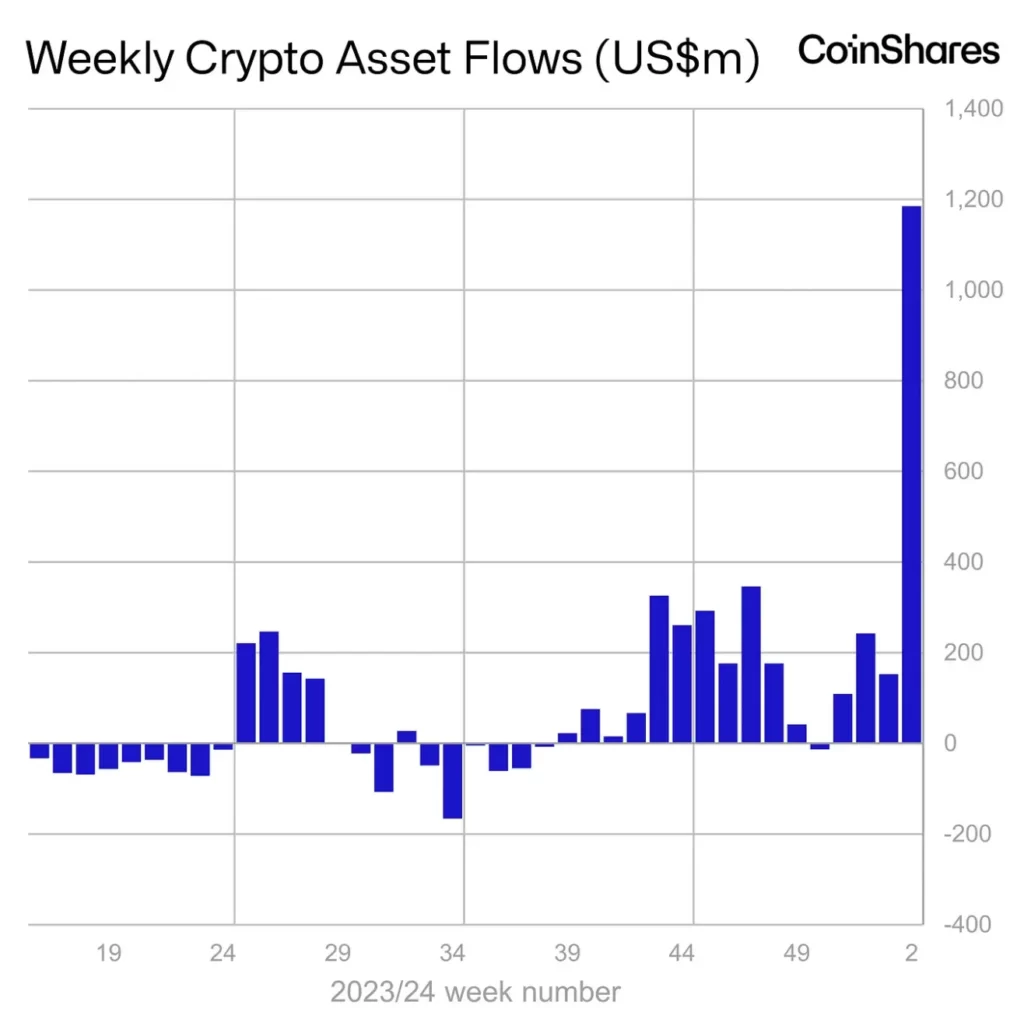

Bitcoin could see a boost from this new capital influx. On their first trading day, spot ETFs attracted $655 million. This figure might stabilize over time, but consistent institutional interest is expected. For instance, Ark Invest’s CEO Cathie Wood mentioned ongoing discussions with various asset managers to ramp up investments.

However, a week in, despite $1.2 billion in inflows, the ETFs hadn’t positively impacted the market. This was due to Bitcoins being purchased over the counter at fixed prices, not affecting the spot price. However, once the OTC market is tapped out, the creation of new shares and subsequent buying could drive up Bitcoin’s price.

If major American funds, where many store their savings, start pouring into Bitcoin through ETFs, we could witness a significant spike in Bitcoin’s value. Consider this: the largest U.S. pension funds manage $9.2 trillion. Allocating even 1–2% of these assets to Bitcoin could trigger a new bull market due to increased buying pressure.

The Drama Surrounding Bitcoin ETFs Approval

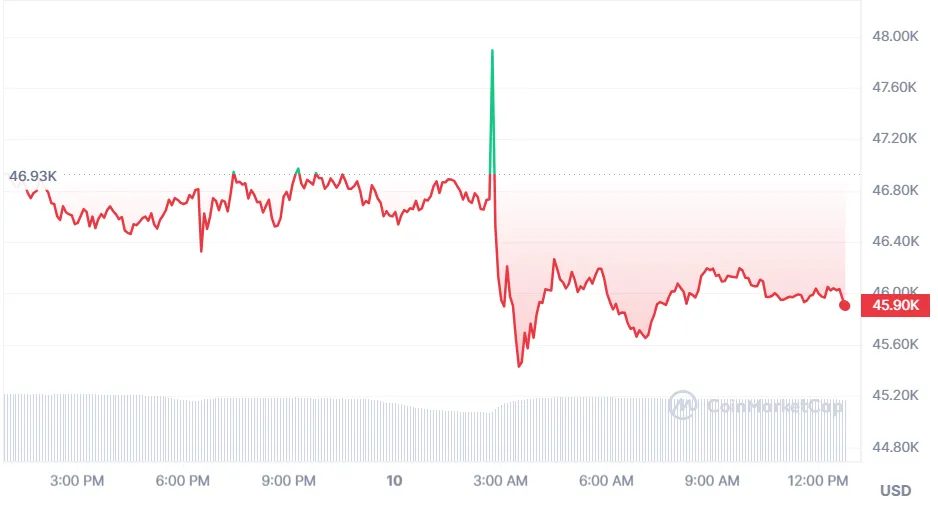

This approval challenges the perception of the SEC as the ultimate regulatory authority. The Commission’s past errors, such as its Ripple accusation or its refusal to allow Grayscale’s Bitcoin Trust to transform into an ETF, are notable. The SEC’s credibility took another hit when, a day before the approval, its Twitter account was hacked, falsely announcing the ETF approvals, causing a brief Bitcoin price surge, only to be refuted by Gary Gensler.

The crypto community questioned the SEC’s ability to safeguard investors in the digital age and its authority in regulating crypto, especially when courts often contradict its positions.

Despite approving the ETFs, Gensler’s reaction was lukewarm. He expressed reluctance in approving the funds, citing court pressure. He also argued that ETFs lead to centralization, contradicting Satoshi Nakamoto’s vision for Bitcoin.

The Future of Blockchain Ecosystem Post-ETF Approval

This approval is a significant step for blockchain technology. First, it signals the tech’s maturity, being technically robust, financially valuable, and compliant enough for regulated exchange trading 15 years post-launch.

Second, it paves the way for further developments, like Ethereum and Ripple spot ETFs, which could further boost crypto market valuations.

Third, it opens doors for major companies to consider blockchain and decentralized finance as practical tools for accounting and execution.

At Dexola, we look forward to more companies exploring and adopting blockchain technology, using Bitcoin and other cryptocurrencies as value stores, and embracing stablecoins for transactions because beyond doubt the future is decentralized and digital.